ABOUT VENDOR FINANCE

How often have you heard clients or prospects say, “I’d love to buy it, but I don’t have the budget available’

Price is always going to be a major consideration in any sale, but a client’s lack of budget doesn’t have to reduce their ability to purchase. Offering clients a no-hassle solution to financing the purchase of your products can help increase sales, accelerate cash flow and assist you in launching new products.

For example, proposing a rental figure of £350.00 a month rather than an outright capital payment of £10,000 should soften the blow and enable your clients to build the cost into their annual budgets.

Our service is all about tailoring packages to perfectly suit you and your clients’ requirements. As experienced independent advisers, we research the whole market to identify the solution that’s right for your clients’ needs. We also manage the entire process, liaising with lenders and ensuring a slick exchange of information and paperwork.

BENEFITS TO YOU

- The finance house will pay you as soon as the agreement is signed and equipment delivered

- Increased sales potential as your products become more affordable

- Offering finance options speeds up the sales process as clients won’t need to seek their own finance arrangements meaning there is less time for competitors to step in

- Once your client has budgeted a monthly set amount to purchase your product it may be easier to sell an upgraded solution. You will not be asking for any up-front capital payments, only an adjustment to the already budgeted figure.

- You will receive full training as well as ongoing internal and external sales support

- You will receive full training as well as ongoing internal and external sales support

BENEFITS TO YOUR CLIENTS

- They can buy what they need not what they think they can afford

- Increased sales potential as your products become more affordable

- Offering finance options speeds up the sales process as clients won’t need to seek their own finance arrangements meaning there is less time for competitors to step in

- Once your client has budgeted a monthly set amount to purchase your product it may be easier to sell an upgraded solution. You will not be asking for any up-front capital payments, only an adjustment to the already budgeted figure.

- You will receive full training as well as ongoing internal and external sales support

- You will receive full training as well as ongoing internal and external sales support

The result?

Well we believe you’ll have the peace of mind that comes from knowing you’ve made an informed decision and in doing that, you’re seeing the benefits of a finance package that’s truly right for your business.

WHAT WE OFFER

- Point of Sale Finance for companies who wish to offer finance to their clients.

- A full service allowing your clients to acquire product without the budget constraints of having to find upfront cash.

- We provide all the support and infrastructure leaving your clients to enjoy all the benefits of using leasing as a tool for Investment.

- Ideal for increasing sales and accelerating cash flow as payment is made on delivery. No more waiting 30, 60 or 90 days for payment.

- Many companies who sell a variety of business equipment could benefit from Vendor Finance. This simply allows you to offer your equipment on a finance installment basis instead of having to charge the full cost upfront.

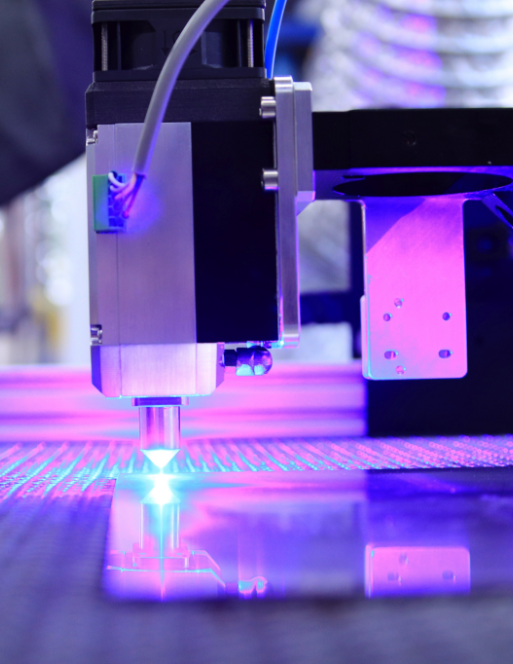

- We cover all types of Office Equipment, Technology, and Software, right the way through to engineering and manufacturing equipment. This list is by no means comprehensive as it covers any business were offering a monthly payment would help your client acquire what they really need and not what they think they can afford.

- We cover all types of Office Equipment, Technology, and Software, right the way through to engineering and manufacturing equipment. This list is by no means comprehensive as it covers any business were offering a monthly payment would help your client acquire what they really need and not what they think they can afford.

What we offer

IT Finance

“Show me a more cost-effective way of managing my IT”

Asset Finance

“I’d rather spend a morning winning a new customer than ringing round finance companies.”

Office Equipment Finance

“I didn’t realise I could Lease all of this equipment?”

Vehicle Sourcing and Finance

Have you ever wished that sourcing fleet vehicles and arranging finance could be less of a headache?

Q&As

Common questions

Why use a finance broker?

In a nutshell, we can survey the whole market and get the best solution from a host of providers, and taking all the work out of trying to find the right funding solution.

What is the benefit over using my bank?

Your bank is your companies core working capital line. It might be required for a rainy day, covering payroll when a debtor is late paying so don’t tie up all your credit with the bank on your equipment finance when this can be sourced through a third party leaving your bank facilities free for emergencies or smoothing the general working capital of the business.

Are the agreements fixed monthly payments?

Yes, all the finance we offer is fixed rate ensuring the business can budget.

What do people mean when they say Leasing is Assured?

In simple terms, a bank can call in the overdraft and, loans on demand even if you have been making the payments on time. But leasing once agreed is set and can never be called in if the payments are being met giving the business peace of mind.

We have paid cash for the equipment and wished we had financed. Can we still finance this?

Yes, this is known as Sale and Leaseback. For equipment up to 12 months old we can finance the full balance. For older equipment, a valuation can be sort and a lend against the current value can be looked at.

How, long does it take to arrange the finance?

If the equipment is available for immediate delivery, we can look to sort the finance out in 48 hours.

CASE STUDIES

Explore our related projects

Frame manufacturer based in Cardiff

Our client is the leading Karting track operator in England, requested that we assist with the opening of their London site to service clients in the center of London.

Distributor of Work Clothing in Warwickshire

We have worked with this group since their formation, providing all their I.T. infrastructure and software to get the business operational

Manufacturer of Leather Goods in Somerset

A dealership with a £100m turnover based in the UK, promotes a range of manufacturers brands. The company operate from multiple sites and we have worked with the group over the last 10 years.

BE IN TOUCH

Work with us!

We can help you resolve difficulties and find ways to accomplish your projects.